What is a U.S. payday-loan comparison calculator ?

USA Payday Loan Comparison Calculator — What Payday Loans Are, How They Work, and What to Watch For

A payday loan (cash advance/deferred deposit) is a short-term, small-dollar loan meant to be repaid on your next payday, usually within 1–4 weeks. Pricing is typically a flat fee per $100 borrowed (e.g., $10–$25 per $100 for ~14 days), which translates to a very high APR because of the short term. Availability, amounts, and fees are governed by state law; many lenders operate only in certain states and may offer alternatives (installment loans or lines of credit) where payday loans are restricted or banned.

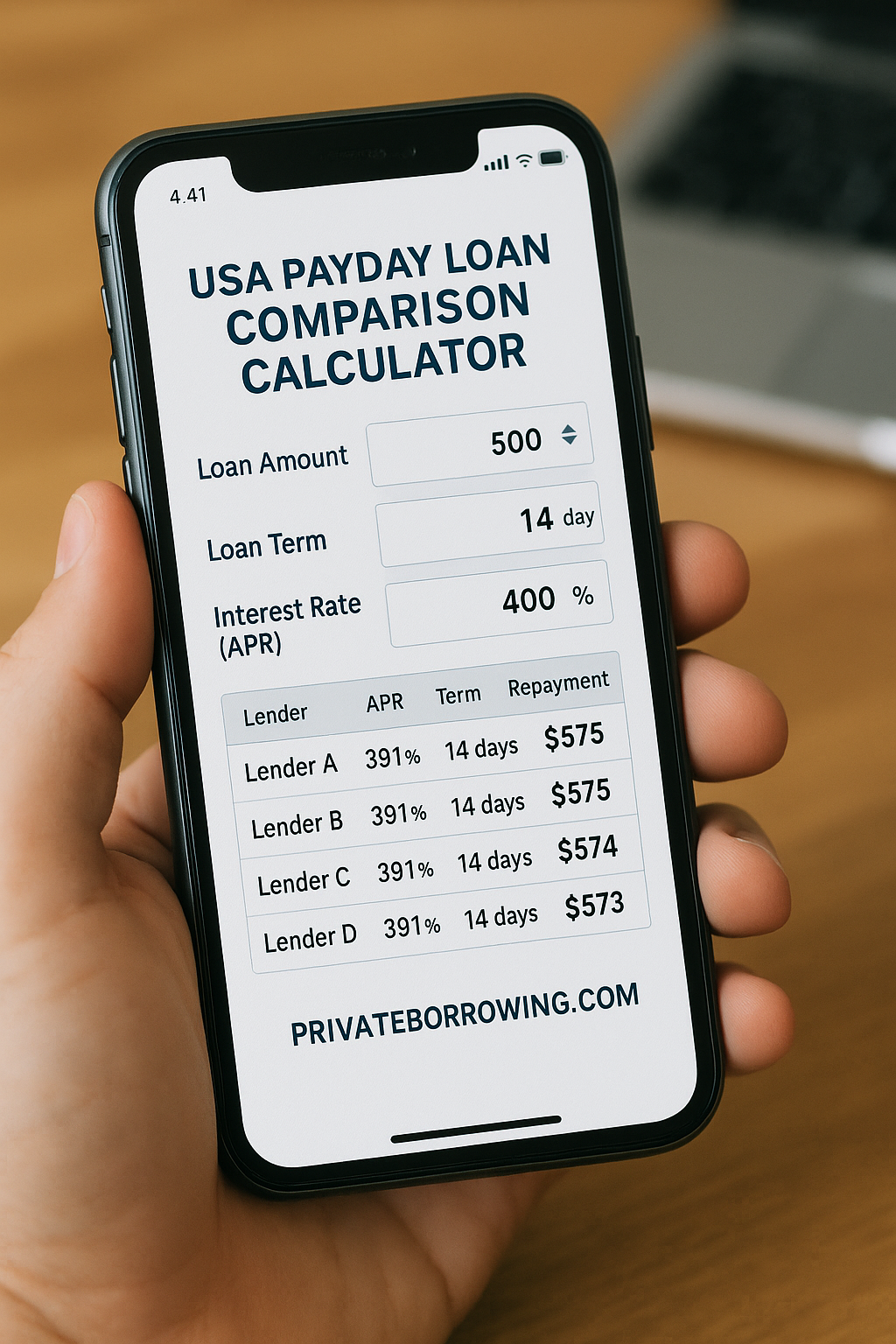

How costs are calculated

- Fee model: Typical examples include $15 per $100 for ~14 days (~391% APR), $13 per $100 in Florida (~339% APR for 14 days), or higher fees in some states. Actual schedules vary by state and lender.

- Single-payment vs. alternatives: Classic payday loans are one-time balloon payments; some lenders also offer installment or line of credit products with frequent payments and high APRs.

Do & Don’t when applying

- Do check your state’s rules and the lender’s state page; verify fees, repayment date, and total payback.

- Do prepare required docs (see below) and budget for full payoff on the due date to avoid rollovers.

- Don’t rely on multiple concurrent payday loans—costs compound quickly and can trap you in debt.

- Don’t allow automatic re-borrowing without understanding added fees; ask about extended payment plans if available in your state.

Typical documentation

- Government-issued ID, age 18+

- Active checking account (or debit card) in your name

- Proof of income and pay schedule (recent paystub or bank statement)

- Valid phone and address; consent to credit or bank-data checks as allowed by state

Compliance & availability vary widely by state; several states and D.C. restrict or ban payday lending entirely. Always review the lender’s state-specific “Rates & Terms” page and disclosures before applying.